Unexpected shifts in commodity prices brought on by natural disasters, market dynamics, or geopolitical events.

Commodity Price Risk Management

If your company handles, manufactures, or uses Beverages, Chemicals, Dairy, Eggs, Economics, Energy, Fish, Seafood, Food Ingredients, Fruit, Juices, Grains, Feed, Herbs, Spices, Plants, Industrial Materials, Meat, Poultry, Metals, Nuts, Seeds, Dried Fruit, Oilseeds, Oils, Fats, Plastics, Textiles, Pulp, Paper, Wood, Vegetables, Pulses, and Transportation commodities.

The ever-changing landscape is influenced by a number of intricate factors, but never more so than in recent years, when Covid-19 and a string of geopolitical crises brought attention to the vulnerability of global supply chains.

Commodity price risk management refers to the methods and resources that investors and companies employ to guard against the financial effects of volatile commodity prices. This is especially important for raw material-dependent businesses like manufacturing, energy, and agriculture, where profit margins can be greatly impacted by price fluctuation.

Our Expertise Types of Commodity Price Risks:

-

1. Price Volatility:

-

2. Supply Chain Risks:

COGS might be impacted and expenses raised by interruptions in the raw material supply.

-

3. Currency Risk:

Because commodities are frequently traded in international currencies, their values are susceptible to changes in exchange rates.

-

4. Regulatory Risks:

Changes in government policies, tariffs, and environmental regulations can impact commodity prices.

Our Commodity Price Risk Management Strategies based in our Platform Algorisms:

-

1. Hedging:

- Futures Contracts: Protect against adverse price movements by locking in a price for future delivery.

- Options Contracts: Give you the flexibility to buy or sell commodities at a specific price.

- Swaps: Agreements to exchange cash flows based on differences in commodity prices, frequently utilized by large corporations.

- Futures Contracts: Protect against adverse price movements by locking in a price for future delivery.

-

2. Diversification:

- Invest in a variety of commodities or asset classes to lessen your exposure to fluctuations in any one of the prices.

-

3. Fixed-Price Contracts:

- To guarantee steady prices and lessen susceptibility to market fluctuations, negotiate long-term contracts with suppliers.

-

4. Inventory Management:

- Adjust stock levels according to price projections; purchase in bulk while prices are low and cut back when prices are high.

-

5. Scenario Planning:

- To establish backup plans, perform routine risk assessments and build models for prospective price fluctuations.

-

6. Insurance Products:

- To protect against monetary losses brought on by extreme price swings, utilize price insurance.

Benefits of Our Effective Risk Management Tools:

- Cost Stability: Assists your company in forecasting and managing expenses in spite of changes in the market.

- Profit Protection: Reduces the impact of pricing fluctuations to protect your profit margins.

- Strategic Decision-Making: Well-informed budgeting and planning grounded in consistent input prices.

- Competitive Advantage: Allows your organization to offer consistent pricing and manage supply chain uncertainty effectively.

Markets Index can assist you in understanding the instruments that may help you reduce or increase your exposure to the commodity prices that determine your operational returns, thereby protecting your company from volatility.

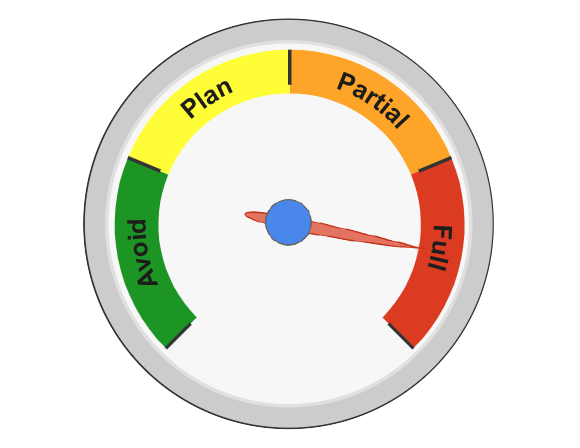

Hedging: Act Decisively

- Avoid: Prices at the top or a confirmed downtrend means hedging is not recommended

- Plan: Anticipated uptrend. Need to plan for a future recommendation to hedge

- Partial: Recommendation to hedge only part of the total volume due to possible “fake signals”

- Full: A confirmed buy signal validating an uptrend suggests the need to hedge

Testimonials from Clients

“Markets Index has established itself as a reliable leader in the industry”

offering dependable data that facilitates meaningful conversations with suppliers, sales teams, and customers. By applying their insights, we can enhance transparency and cultivate stronger partnerships throughout the supply chain.

Roger Federal

Uses Saxolvestor“The accessibility of Markets Index's tools strengthens our negotiation position with suppliers”

Helping us secure more favorable agreements while conserving valuable time. Furthermore, their platform simplifies internal workflows, boosting overall productivity and enabling our team to concentrate on strategic goals.

Roger Federal

Uses Saxolvestor“Markets Index’s Forecast Service delivers comprehensive analysis and practical hedging strategies”

equipping our organization to make well-informed, data-backed decisions. With this level of insight, we are better positioned to adapt to market trends with confidence and maintain a competitive edge in an evolving business landscape.